Social Security Benefits Maximizing

SSASocialSecurity.com

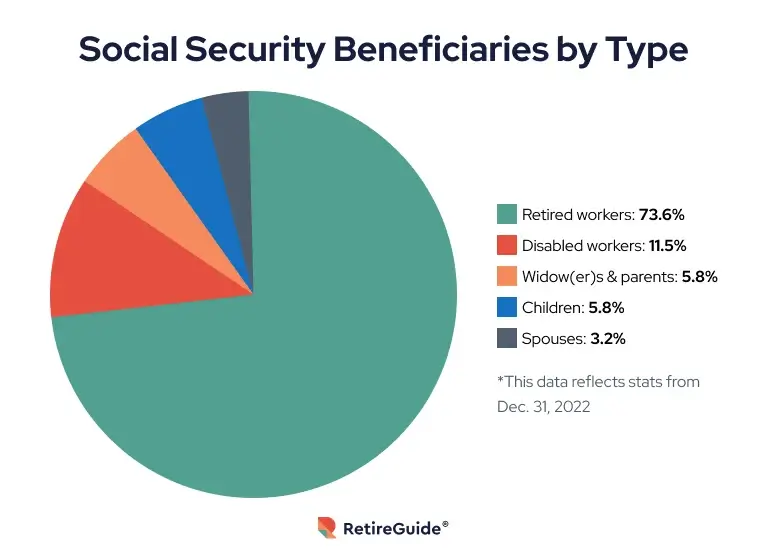

To secure with Social Security benefits your future financially then, planning for retirement is the most essential part of financial security. In the United States of America, millions of Americans are getting SSA benefits. When you understand how to maximize the benefits after retirement, you will see a big difference in your lifestyle.

Eligibility for Retirement Social Security Benefits

To qualify for SSA benefits after retirement, you have to work and pay the SSA Social Security taxes for at least 10 years. The receiving amount will be dependent on your earning history and also depends on the age at which you start to take the benefits.

Strategies to Maximize Benefits

- Delay Your Retirement Age:

- When you start taking benefits at the age 62 as compared to age 70 both benefits are different. Full retirement age (FRA) or even later it will increase your monthly payout. Retirement at the age 70 boosts the benefits 32%.

- Coordinate with Your Spouse:

- SSA Spousal Benefits can impact your benefits, it will maximize your income. Like when your spouse claims the benefits in the results you will maximize the household payout.

- Understand the Impact of Working During Retirement:

- If you claim benefits before your FRA while continuing to work, your benefits may be reduced. Knowing the earnings limit is critical to avoid penalties.

Common Challenges and Solutions

- Any misunderstanding in eligibility criteria. Just open the SSA’s online tools from the official website and here you can calculate the benefits and clarify all the misunderstanding in the eligibility.

- Missing or forgetting critical deadlines. Just a simple pin on your board in the home wall or also you can set the reminder of key dates in your cell phone to apply on time.

- Sometimes facing the issues in finding the SSA Office near me. just simply use the SSA Locator

Conclusion

Be relaxed and fully focused on understanding your Social Security options; it will result in your financially secure retirement. Just collect the right data, and with that correct information, you can make the right decisions to fulfil your goals and retirement lifestyle.